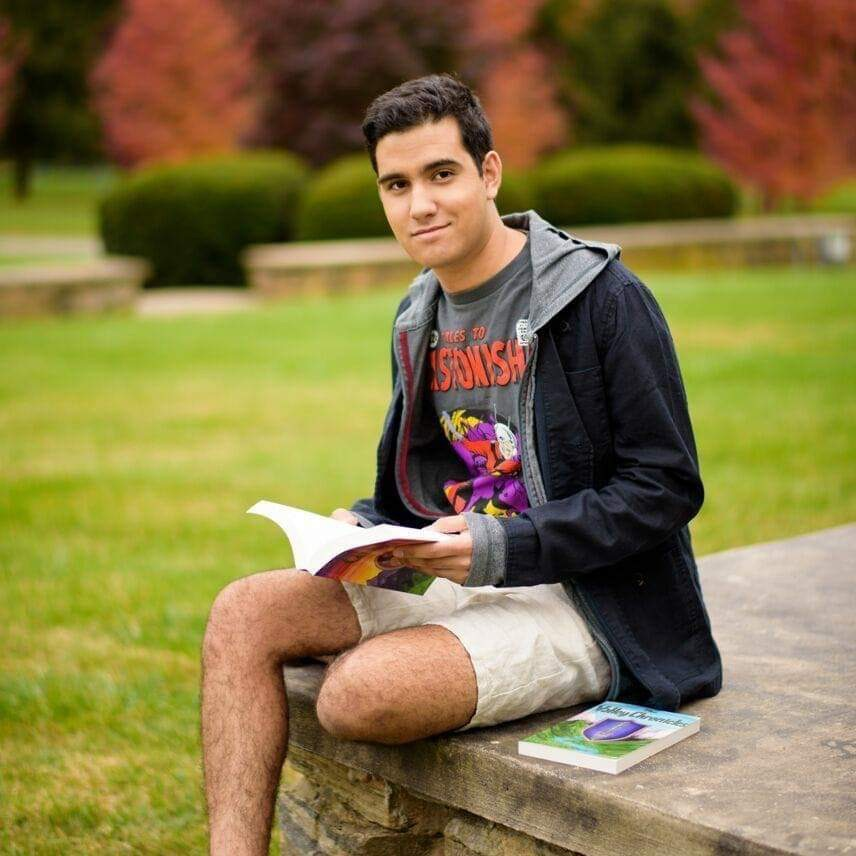

Your gift is creating life-changing opportunities for the children of the Submarine Force. Together we are easing the financial burden of continuing education for over 100 scholars worldwide. Thank you for your support.

What We Do

Dolphin Scholarship Foundation currently sponsors 113 students, who each receive an annual scholarship of ranging from $2,600 to $4,000. Each recipient may potentially receive a total of $16,000 for up to eight semesters of undergraduate study. The number of new awards granted each year is determined by graduation/attrition of current Dolphin Scholars and donations. Dolphin Scholarship Foundation is proud to have awarded over $14,000,000 to more than 1,500 students attending universities and colleges through the United States.

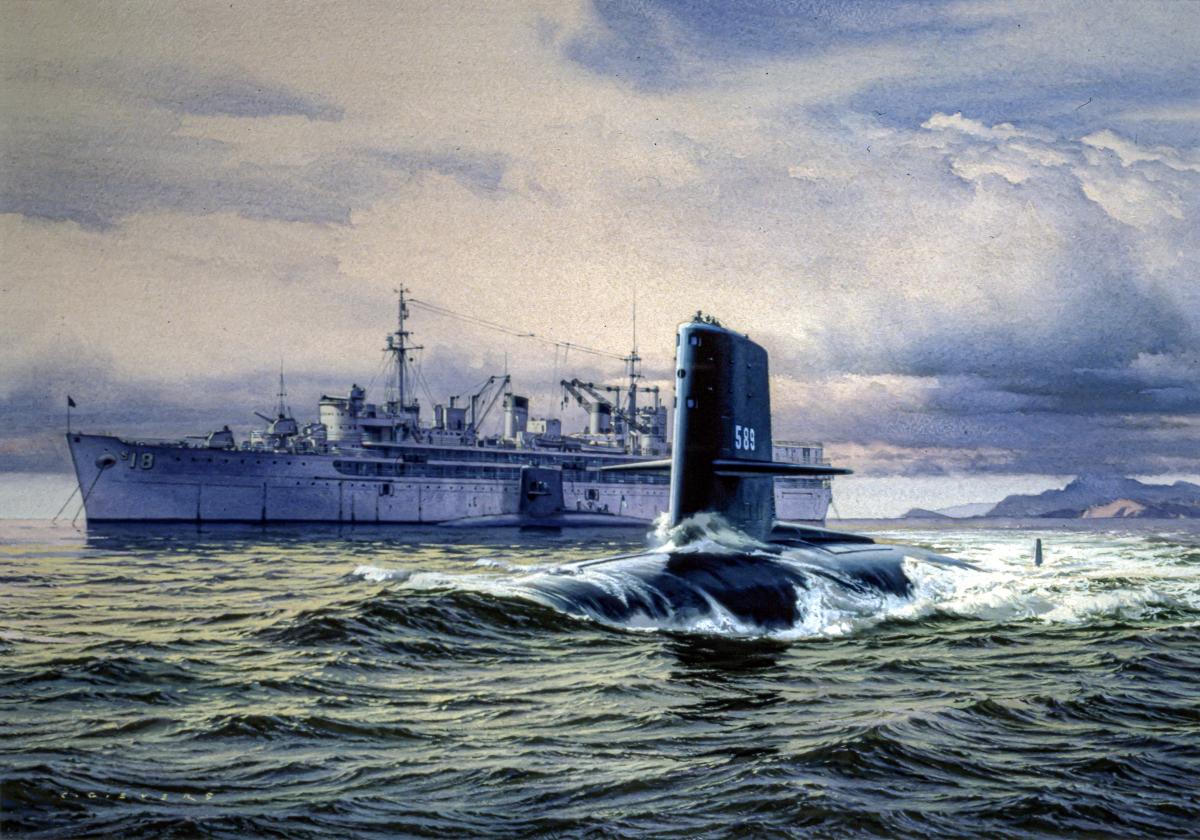

DSF also proudly administers the Laura W. Bush Scholarship, the USS Colorado (SSN 788), the USS Delaware (SSN 791), the USS Hampton (SSN 767), the USS Indiana (SSN 789), the USS Montana (SSN 794), the USS Nautilus (SSN 571), the USS Oregon (SSN 793), and the USS Washington (SSN 787) scholarships.

Our Story

The Dolphin Scholarship Foundation was established in 1960 with the first scholarship of $350 awarded to John L. Haines, Jr. in June 1961. Funds were raised through the efforts of submarine officers’ wives’ organizations throughout the United States. DSF continues to receive strong financial support from submarine spouse organizations and the submarine community as well as support from individuals, corporations, memorial gifts, and Combined Federal Campaign. Donations go directly to support scholarships; income from DSF investments supplement these contributions for scholarships and operating expenses. Dolphin Scholarship Foundation also conducts fundraisers such as the Annual Cartoon Calendar (since 1963), Annual Golf Tournaments, virtual submarine races, and the “Pride Runs Deep” pin designed by Ann Hand.

Featured Sponsors